The Barriers to Net-Zero Buildings

Cost decreases and technological advances could rouse the market for net-zero energy buildings from dormancy within the next two decades, according to a recent report by Pike Research.

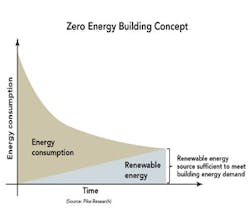

Net-zero energy buildings produce as much energy on-site as they consume in a year. Many technologies needed to reach this goal, such as high-efficiency HVAC systems, are already available affordably. However, products like triple-glazed windows and solar panel installations are frequently not cost-effective for building owners compared to conventional alternatives, researchers noted. Thus, only a handful of zero energy buildings have been constructed despite growing interest in the concept.

Electrochromic glass technology, for example, is relatively new today but will continue to improve in durability and performance while dropping in cost, making it a stronger alternative to conventional glazing systems, researchers predict.

Stringent government regulations similar to the European Union directive mandating near zero energy construction in all new projects by 2021 will drive down costs and encourage energy-efficient innovations in the U.S. As this effort ramps up, worldwide zero energy building revenue could reach an estimated $690 billion by 2020 and $1.3 trillion by 2035, according to the forecast.

“While several dozen buildings of this type have been constructed in the United States, the market as a whole remains essentially dormant,” says senior analyst Eric Bloom. “That is changing as advances in building technology provide breakthrough solutions to energy efficiency and renewable energy challenges while driving down costs for existing technologies.”

The report, Zero Energy Buildings, details the size and growth of zero energy building markets, including building systems, renewable energy, and construction soft costs, as well as drivers and trends for zero energy buildings in key markets.