Is Retail Performance a Crystal Ball for Office?

At first glance, BOMA International’s 2009 Experience Exchange Report (EER) results suggest that the office market held its own in 2008. The 2009 EER, which is comprised of data from 2008, indicates that office building owners and managers reported modest gains in income in 2008.

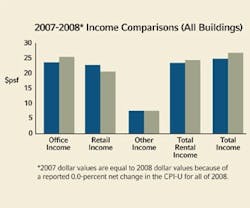

In order to gauge year-over-year performance, BOMA compared 2-year "same-building" analysis of properties that provided income and expense data in 2007 and 2008, and did not report a change in occupancy greater than 15 percent or a change in square footage greater than 10 percent. In that data set, which was comprised of roughly 1,000 office buildings, income increases were reported across most income categories, with office income increasing 7 percent, total income increasing 5.4 percent, and rental income increasing 4.2 percent. However, the EER retail data show a significant decrease in income, which dropped sharply from $23.39 per square foot in 2007 to $20.45 per square foot in 2008 (12.6 percent).

The decline in retail income in 2008 may be a telling sign of the direction of the other office income categories tracked in the EER in 2009, as many analysts agree that the rentable office space market is a lagging indicator of economic activity during times of recession.

Property owners and managers with retail space reported significant erosion in key performance metrics. While total square footage remained largely unchanged, average retail rental income declined (more than 23 percent per building and close to 18 percent on a square footage basis) in 2008 compared to 2007. Building owners also reported a significant loss of retail tenants, with an average of six tenants per building in 2008 compared to 20 per building in 2007. Such a decline mirrors the overall performance of retail in the current market cycle.

In the August issue of Cycle Monitor, Glenn Mueller reports that retail rents and occupancy declined almost 2 percent in 2Q09, and were both down by close to 5 percent over the same period last year. He forecasts that retail occupancies will decline by almost 2 percent and rents by 8 percent in 2009. This analysis, along with the fall off in retail sales and news of the bankruptcies of some large retail conglomerates, paints a dismal picture of the opportunities for retail space within office buildings for 2009 and beyond.

The downturn in rent and occupancy from retail over the past few years is hardly surprising given the sharp declines in consumer spending, and these numbers only drive home how difficult the current market cycle is for the office sector. Although the retail area comprises a relatively small percentage of total rentable area in the EER data set, which is primarily concerned with tracking performance of buildings with at least 70 percent of rentable space dedicated to office uses, it nevertheless represents an important income stream for these assets. As most markets begin to face declining rents for office area as well, the declines in retail rents will likely mean more pressure on NOI.

In September, Chairman of the Federal Reserve Ben Bernanke declared an end to the recession, but stressed that a recovery would be slow. And, although the U.S. Department of Commerce announced that consumer spending rose 2.7 percent in August, consumer confidence is still shaky at best. Beyond that, jobless claims continue to increase, albeit more slowly than they did in the first two quarters of the year. These are the indicators that owners and managers of office assets will watch carefully, as employment is a key indicator of demand for office space and can signal impending signs of recovery in this sector.

In other EER results of note, total operating expenses increased moderately (6.4 percent), from $7.51 in 2007 to $7.99 in 2008. The highest increases were in roads/grounds (23.5 percent), administration (10.5 percent), security (8.3 percent), and cleaning (7 percent). Utility expenses decreased marginally (1.3 percent), dropping from $2.31 per square foot in 2007 to $2.28 in 2008. This decline may reflect the fall in energy prices in the second half of the year, as well as energy-conservation efforts by commercial property managers. Fixed expenses, including items such as real estate taxes, personal property taxes, and building insurance, increased from $3.96 per square foot to $4.14 per square foot (4.5 percent).

James A. Peck is chair and CEO at BOMA Intl. and senior director of asset services at CB Richard Ellis in Albuquerque, NM. He can be reached at [email protected]. For more information on this and other topics, call BOMA Intl. at (202) 408-2662 or visit www.boma.org.