Is a Recovery in Sight in 2004?

Washington, D.C. – As 2003 came to a close, the economy was showing signs of life and optimism was increasing that a more robust recovery may be in store for 2004. Looking solely at real estate markets, 2003 was another tough year. Most major U.S. markets went from near-record tightness to near-record softness in just two years, but analysts suggest that we may have reached the bottom of the cycle and will begin to see some improvement soon. For the eighth straight year, BOMA International’s Experience Exchange Report (EER) indicated positive growth in net operating income (NOI). The 2003 EER (based on 2002 data) private-sector survey results are the weighted average responses of 2,531 buildings representing approximately 500 million square feet of space. Net operating income was $15.54 per rentable square foot, up 6.4 percent (4.7 percent in real terms) from the 2001 level. Building owners and managers accomplished this positive NOI growth by increasing total income by 5.9 percent.The 2003 EER also shows that most operating expense components increased from 2001, with the exception of utilities, which decreased by 5.1 percent. The California energy crisis in 2001 was the factor behind the increase in energy costs in 2001, and the costs seem to have leveled off in 2002. The U.S. private-sector market reported spending $1.87 per rentable square foot on utilities in 2002 vs. $1.97 in 2001. As expected, in a post 9/11 world, the largest increase occurred in security costs. With concerns about security looming, the U.S. office market industry reported spending 14.3-percent more on security.

Total Expense Ratios demonstrate the overall ratio of individual operating expenses and fixed expenses to total expenses in the U.S. private sector.

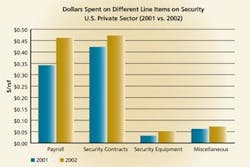

Dollars Spent ... shows the dollars spent on different line items in security by the U.S. private sector in 2001 and 2002.The commercial real estate industry has always had comprehensive emergency preparedness plans in place, even prior to the events of September 11, 2001; but as these events riveted our attention, building owners and managers responded by strengthening existing security systems and making changes in their operations. Both private and government sectors reported spending considerably more on security in 2002 vs. 2001.Corporate facilities, which typically comprise high-profile, Class A buildings, reported increasing their overall security expenses by 13 percent ($1.03/rsf in 2002 vs. $0.91/rsf in 2001), according to BOMA’s Experience Exchange Report 2003. The dollar amount spent by corporate facilities on security contracts went up by 35 percent in 2002 ($0.73 vs. $0.54 in 2001). Security contracts include both guard and monitoring contracts.

A large number of corporate facilities have also implemented tighter vendor security, including vendor check-in procedures and requests for vendors to conduct employee background checks. Special attention is also being paid to parking decks and garages, where bombs can be planted in entering vehicles. The dollar amount spent on security equipment also increased to $0.15/rsf in 2002 vs. $0.06 in 2001 – the costs of acquiring and upgrading cameras, monitors, and alarm systems accounted for a large portion of this increase. The trend to increase security spending is likely to continue for the next couple of years before it levels off.What Does This Mean?Most industry experts seem to agree that 2004 will see improvements over 2003, though the road is not expected to be smooth. Companies must be flexible and nimble to keep up with the changes. BOMA International strives to keep abreast – and ahead – of these changes. On matters of public policy, BOMA has been instrumental in enacting legislation to help ease the tax burden on the real estate industry. Even more importantly, many proposals that are floated on Capitol Hill and before decision-makers that are potentially detrimental to our industry never come about as a result of the efforts of BOMA International and the local BOMA associations across the United States and Canada.For more information, visit the BOMA International website (www.boma.org) or call (202) 408-2662.

A large number of corporate facilities have also implemented tighter vendor security, including vendor check-in procedures and requests for vendors to conduct employee background checks. Special attention is also being paid to parking decks and garages, where bombs can be planted in entering vehicles. The dollar amount spent on security equipment also increased to $0.15/rsf in 2002 vs. $0.06 in 2001 – the costs of acquiring and upgrading cameras, monitors, and alarm systems accounted for a large portion of this increase. The trend to increase security spending is likely to continue for the next couple of years before it levels off.What Does This Mean?Most industry experts seem to agree that 2004 will see improvements over 2003, though the road is not expected to be smooth. Companies must be flexible and nimble to keep up with the changes. BOMA International strives to keep abreast – and ahead – of these changes. On matters of public policy, BOMA has been instrumental in enacting legislation to help ease the tax burden on the real estate industry. Even more importantly, many proposals that are floated on Capitol Hill and before decision-makers that are potentially detrimental to our industry never come about as a result of the efforts of BOMA International and the local BOMA associations across the United States and Canada.For more information, visit the BOMA International website (www.boma.org) or call (202) 408-2662.