Financial Benefits of Pre-Installation of the Telecommunications Infrastructure

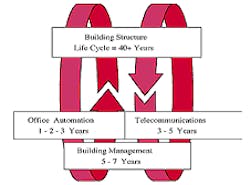

A typical commercial office building has a 40-50 year life as shown in Figure 2 (Courtesy NAIOP). By contrast, the telecommunications systems have a 3-5 year life cycle, after which they typically need to be completely overhauled or upgraded.

From a business perspective, it is crucial that the building owner control as much of the infrastructure as possible. By designing the telecommunications infrastructure to be as robust as possible, it is conceivable that the telecommunications life cycle can be increased to as much as 10 years or more. This is achieved by installing the latest technology at the outset, and sizing it to allow for future growth in demand, while minimizing re-construction costs. The independent telecommunications consultant should have the industry knowledge and relationships to help minimize the frequency of upgrades to the telecommunications infrastructure.

The cost of installing the minimum acceptable telecommunications infrastructure in a building (riser conduit, copper to the basement demarcation point and telecom closets on each floor) is typically estimated at $6-$8 per square foot of leasable space. Each tenant will then be required to extend this copper infrastructure to their workspace. If tenants want fiber, satellite or cable in their suite, additional construction and installation costs will be incurred. This basic infrastructure will have to be upgraded on a 3-5 year cycle. The cost for logistics, management and maintenance of such a system will be considerable.

A robust, multiple service provider broadband backbone in a building will cost about $15-20 per square foot to design and install and extend throughout the building. The infrastructure will include copper, fiber and coax, extended to each tenant suite in a highly flexible network grid. This backbone should require no upgrades or major modifications for at least 10 years. Initially the cost may seem high - about 3 times the cost building owners are used to spending. However, the savings in future upgrade and maintenance costs will far exceed the initial cost. In addition, the owner can pass the additional costs on to the tenants, in the form of higher lease rates.

The rooftop is one of the most lucrative (and often ignored) portions of the building. By owning and leasing any towers on the rooftop, the building owner can generate a significant additional revenue stream. Table 4 demonstrates that a rooftop tower will generate positive cash flow with only a single tenant, and yields extremely high (70%) margins and return on investment.

Year 1Year 2Year 3Year 4Year 5Tenants/Tower 1.01.52.02.53.0Average Monthly Rent $1,500$1,560$1,622$1,687$1,754Annual Revenues $18,000$28,080$38,928$50,610$63,144Recurring Costs(land rent, taxes, maintenance, insurance etc.) $11,500$11,960$12,438$12,936$13,453Tower Cash Flow (TCF) $6,500$16,120$26,490$37,674$49,691TCF Margin36%57%68%74% 79%ROA (assuming $225k cost per tower)3%7%12%16%22%Table 4. Telecommunications Tower Cash Flow Projections (courtesy Punk & Zeigel)