Most facility managers use “Simple Payback” to evaluate and prioritize projects for approval and implementation. While this may work well for organizations that plan only for the short term, it may not be the best way to evaluate projects if you are thinking long term. In fact, most energy saving projects yield benefits over the long term, so if you only use simple payback, you may not be telling the whole story and may actually be choosing the wrong projects.

BACKGROUND OF NPV:

All projects compete for funding and financial managers usually decide where the money goes and which projects get approved. Therefore, in this competitive environment, if facility managers want to get more energy management projects approved, it is important that they understand and be able to speak the financial manager’s language, which may include many different types of financial evaluations such as NPV, IRR, ROA, etc. Many facility managers know that simple payback:

= (Project Investment) / (Annual Savings) may only tell part of a project’s benefits.

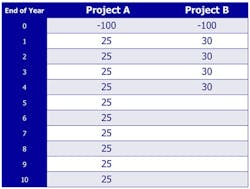

For example, if you are a CFO and have to pick one of the projects in the Table below, Project B would have the shorter payback period (3.3 years versus 4 years for Project A). However, if the CFO is thinking long term, then Project A would yield more benefits because it lasts longer.

This example highlights the fact that when comparing two projects using simple payback the evaluation ends when the first simple payback is reached (3.3 years), and all other cash flows that occur after that point in time are not a part of the evaluation. A truly “fair” evaluation would have projects of equal lives, but often the scenario above does occur in real project prioritization activities.

WHAT is NPV?

Net Present Value is an evaluation method used by financial managers to determine the overall value of a project (or a series of cash flows). NPV represents the value in today’s dollars of all future cash flows. As you know, the value of money received today is worth more (assuming you can earn interest) than money received in the future. Thus, money received in the future must be “discounted” to estimate its Present Value.

To illustrate the overall objective of NPV, we often use Cash Flow Diagrams, like the one below, where we may be given some information like:

- the annual savings amount ($5,000 per year in the diagram);

- the interest rate (15% per year);

- the number of payments (N)

Usually, we have these variables and want to find the Present Value of these cash flows (P). In this case, we would “move” the future cash flows back to the present time (time = 0). As mentioned previously, when moving the cash flows back in time, we would “discount” the amounts.

This “discounting process” occurs for any cash flow (positive or negative) that occurs in the future. Because “upfront costs” (a negative cash flow) occur at time = 0, we do not need to move them through time (we don’t discount them).

There are many methods to discount the cash flows, such as using a financial calculator or interest table.

Once we have discounted the cash flows back to time = 0, then we will have a Present Value for the Positive Cash Flows, and a PV for the Negative Cash Flows. The difference between these PVs, gives us the Net Present Value.

The greater the NPV, the more the project is worth to our organization. If the NPV is negative, then the project will simply detract value from the organization.

Another common financial evaluation metric is called the Internal Rate of Return, which can be derived using similar processes, although using a financial calculator is far quicker. It is important to note that IRR is related to a “project” or set of cash flows.

In contrast, the Interest (or discount rate) applied to a project is based on company preference labeled MARR. If you ask a company about their Minimum Attractive Rate of Return “MARR”, they are basically telling you the “hurdle rate” for them to take action (fund a project). Every company (and person) has a MARR and it basically means that they can invest and earn this rate elsewhere, so your project has to have a return greater than the MARR.

Once we discover an organization’s MARR, we should use that rate as the discount rate, so that we are treating the future cash flows of a potential project the same as if we were investing it elsewhere.

Once understanding how to calculate NPV and IRR, you can use these tools to your advantage when presenting energy management projects. As it is likely that your projects will yield many long-term benefits, illustrating these via NPV will allow your project to “show” better than if you just used Simple Payback.

In addition, you can use NPV and processes mentioned in the webinar to better negotiate terms with your project suppliers and improve the financial results.

View the webinar and find out how NPV is calculated and used to your advantage http://profitablegreensolutions.com/?q=resources/npv-webinar