The COVID-19 pandemic caused a temporary drop in emissions in 2020, but they have since rebounded, with transport and building operations being the top two contributors to CO2 emissions at 37% and 27%, respectively. While there has been significant progress in electrifying transportation through the adoption of electric vehicles (EVs), buildings have not gotten the same level of attention and improvement.

There are a number of reasons why this is the case, the main one being complexity. EVs are produced in assembly lines and sold at a mass scale through well-known and respected manufacturers. The built environment is much more complicated than the auto industry, with a crowded value chain and frequent retrofits without long-term planning.

For example, each building is designed with a distinct purpose that changes as tenants, managers, and owners come and go. While Americans spend 90% of their time indoors, buildings are so complicated that most of us lack even a basic understanding of our home or office boiler rooms. Yet, we expect buildings to outlive cars, sometimes by generations.

However, with changing market structures and an explosion of building data, it's time to tackle building efficiency, reduce sector emissions and realize the trillions of dollars of operational savings potential.

Changing Market Structure

Unlike the auto industry, which is dominated by manufacturers, building equipment suppliers have not achieved the same market chokehold due to a messy value chain. The divide between energy and real estate has left customers fed up and with a strong willingness to find workarounds that threaten the business models of legacy companies by positioning them at the top of the food chain.

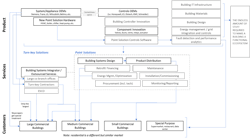

Traditional Building Market Structure

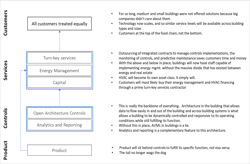

Scalable technology will enable similar service levels across all building types and sizes, allowing customers to enjoy equal options and treatment. Outsourcing integrated contracts to manage controls implementation, monitoring and predictive maintenance will increasingly save customers time and money and close the divide between energy and real estate.

With a focus on reducing indirect emissions, HVAC will become its own asset class, and customers will most likely buy their energy management and HVAC financing through a turnkey services contractor.

Open architecture controls, analytics, and reporting will be the backbone of improving energy efficiency, especially as data easily flows in, out and across building systems. The transition to a new, clean, and efficient building market structure will make providers with closed systems obsolete, align incentives for energy reduction, and integrate building efficiency controls and energy solutions. All of this will allow dynamic building control and responsiveness to operating conditions while maintaining function.

Future Building Market Structure

Where We’re Going

Today, we’re somewhere in the middle of this transition to a new and efficient building market structure. Additional industry predictions include:

- Providers with closed systems attempting to protect their own data will become obsolete.

- The incentive misalignment between capital markets, real-estate owner and operator, service provider, tenant and regulator is fading. With accurate and available data on the true costs of efficiency and impacts on energy use, everyone’s goals to reduce energy use and cost are generally aligned to allow united forward movement.

- There has been a disconnect between building efficiency controls and energy solutions, which have largely failed to integrate and, therefore, scale. These market sectors must align in the future.

- Many real-estate owners lack focus and understanding of their boiler rooms. Outsourcing ownership can provide credit and cost stability, along with operating reliability. As such, HVAC will benefit from becoming a standalone infrastructure asset class.

Improving building efficiency will require leadership, courage and technology, with companies already taking action. Building operational and energy efficiency investors must continue to dedicate funds to advancements in turnkey solutions, point hardware solutions that scale at a portfolio level, energy services that integrate with open controls architecture, and lowering the friction cost of CapEx retrofits. Empowering the right leaders to apply financial pressure will benefit customers and progress toward climate change goals.

About the Author

Ben Birnbaum

Ben Birnbaum is a partner at Keyframe Capital.