BSRIA: Building automation controls face a long comeback in some countries

In a study on the global building automation controls (BACs) market released on March 2021, BSRIA (Building Services Research and Information Association) details the extent to which the market has been set back by the Covid-19 pandemic. Covering 21 countries, the study confirms that the value of BACs products sold fell considerably during the pandemic.

“The pandemic has hit BACs much harder in some countries than others,” BSRIA said when announcing the study’s availability. “While every market we studied showed a fall, in China, Germany and much of Northern Europe the fall was comparatively small. In contrast, the markets in India, Brazil and Mexico were especially badly affected and, in the case of India, profoundly so. Major projects were cancelled, delayed, or impeded, with factors such as lockdowns and the general reduction in economic activity contributing to the process.

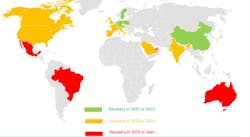

“While there is still a lot of uncertainty about the future course of the pandemic, there is broad expectation that the global BACs market will take until 2023 to return to pre-pandemic levels,” BSRIA continued. “While countries like China and Germany look set to recover more quickly, a few countries such as Brazil, Mexico, Australia, and the United Arab Emirates may not recover until after 2025.”

BSRIA senior manager Lone Hansen elaborated on the pandemic’s major disruption of vertical markets. “Normally, when we report on areas like vertical markets, we are talking about long-term incremental change,” Hansen said. “This year we have seen some quite dramatic upsets. As might be expected, sectors such as offices, hotels, retail, and transport have been hard hit by lockdowns, travel bans and social distancing.

“On the other hand, many countries have been investing in upgrading health facilities,” Hansen continued. “The huge growth in home-working, teleconferencing, and e-commerce has also had a major impact on demand for data center capacity, which is feeding through into BACs. Some of these changes may be short-term reactions; others are likely to have a lasting impact. The fall in the office market, while small to date, could be an early sign that the position of the office as we know it is under threat.”

She added that other long-term trends are continuing: “Whilst the value of BACs software fell marginally, the fall in BACs products was much larger. The relative growth in software is part of a movement toward buildings where the collection, processing and analysis of data is key to making the buildings operate more efficiently.“Another indicator of this is that sales of sensors are forecast to increase faster than for other types of field devices. This could be a concrete signal of a growing emphasis on well-being in buildings. There was already interest in well-being in buildings before the pandemic. Now it is shifting from being a nice-to-have to something that is indispensable if you want to persuade people to return to work. Sensors have a key role to play, from measuring air quality to monitoring occupation levels.”

This study from BSRIA also confirms the continued growth in IP connectivity across a wide range of field devices. Building systems continue to become more converged. While cost and complexity continue to be barriers, this could be changing, BSRIA explained.

“Prior to the pandemic, while people talked about well-being in buildings, the focus was on areas like energy efficiency, which was well understood and could be measured—which made it easier to calculate return on investment,” BSRIA added.

“Now priorities have changed as building owners need to find ways to entice people back. A safe, healthy building is likely to be a smarter building because creating a safe indoor environment means getting the various building services to work in concert to provide people with fresh air, enforce social distancing and ensure a clean, secure space. All of this means that we are in for a particularly exciting time when everyone involved in the building automation industry will need to keep ahead of the new demands a changing world is placing on us.”

BSRIA’s BACs market studies for 2021 are available for the U.S., China, Australia, France, Italy, the U.K., and the United Arab Emirates. Each study includes PowerPoint and Excel deliverables. A global overview and summary is also available.

More information on this and other BSRIA reports is available by calling or emailing your nearest office. In Europe: [email protected]; +44 (0) 1344 465 540. In the U.S.: [email protected]; +1 312 753 6803. In China: [email protected]; +86 10 6465 7707.