Evaluating Electricity-Buying Strategies for Industrial Buildings

Provided by Strategic Energy

Faced with global competition and rising domestic production costs, management across all departments of the industrial business must continually scan their enterprise for cost-control opportunities. Such efforts can often hit a road block at energy management. Policies and equipment that curb energy use are obvious solutions - with a clear return on investment - while energy procurement is often perceived as unpredictable and uncontrollable. Many industrial businesses have seen bottom lines punished by volatile energy market conditions over the past several years. Volatility has become the norm, but, for industrial businesses in deregulated markets, spikes can be opportunities. The means to taking advantage of these opportunities resides within the wholesale electricity market and requires a departure from traditional procurement approaches.

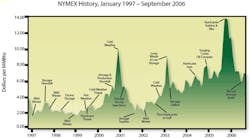

view larger image

Today's Market: Unprecedented Volatility with No End in Sight

New York Mercantile Exchange (NYMEX) natural gas futures contracts drive 80 to 95 percent of changes in electricity pricing, and the factors that affect natural gas are in continual flux. In recent years, the market has been subject to a confluence of unpredictable events in nearly every factor of the supply-and-demand equation, triggering radical price fluctuations. With dependency on natural gas for the electricity-generation process expected to exist for at least a decade, industrial businesses that wish to remain competitive can do well by preparing to stand resilient amidst energy-market volatility.

Challenges and Advantages of High Electricity Consumption

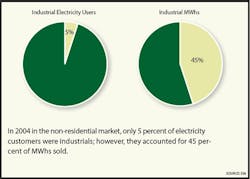

Electricity typically represents a substantial portion of the total energy spend for industrial businesses. According to the Washington, D.C.-based Energy Information Administration (EIA), in terms of units, electricity accounts for 11 percent of industrial energy consumption. The average industrial electric customer consumes 10 times the electricity of a commercial electric consumer, says the EIA. The combination of high loads and low operating margins produces a scenario in which small fluctuations can create a significant impact on the bottom line.

High consumption also offers advantages. Industrials with a peak demand of 1 MW or greater can gain direct access to the wholesale electricity market, with the ability to construct a portfolio of procurement options similar to those for natural gas. Like any commodities market, a successful portfolio approach begins with an understanding of risk tolerance. All procurement opportunities must be examined through the lenses of business cycles and long-term objectives. This business intelligence becomes the platform of a buying strategy that supports energy budget goals, long-term cost control, and continual improvement.

Defining Cost Control

It's important to provide a clear definition of cost control within the context of a volatile market. It should go without saying that cost control should not be confused with immediate cost savings, although wisely calculated buying decisions may produce cost savings over time (or at moments in time).

To experience the greatest benefits and most sustainable competitive position, the business must commit to an electricity-buying strategy that advances the business toward production and profitability targets over the long term. This distinction is important: To achieve maximum value, all elements of the supply contract should support continuous cost management, and price is just one factor in determining value.

The Fixed-Price Approach: Re-Examining the Myth of Low Risk

On the surface, an electricity-procurement contract that locks the entire load at a fixed price would appear to give the greatest degree of budget certainty and, in turn, the greatest degree of cost control. This approach is typically perceived as a shield from market volatility risks. However, from a different perspective, it becomes clear that a purely fixed price plan is not entirely free of risk. It delivers maximum cost control in only two conditions:

- If actual usage does not significantly depart from estimates (+/- 10 to 20 percent).

- If the lock-in price secured through a formal RFP is timed, by chance, for a period when pricing is historically low.

Volatile energy market conditions make it particularly difficult to gain assurances that the price set at contract is truly advantageous for the long term. The procurement contract is driven by a deadline to ensure continued supply; the market is driven by diverse factors that have no regard for contract expiration dates. Incorporating a market-based product into the buying strategy enables opportunistic buys, including the lock-in of low-end prices for forward positions.

Five Fundamentals for Evaluating Buying Strategies with a Cost-Control Perspective

Industrial businesses can best prepare for procurement on the wholesale market by developing and committing to a long-term cost-control strategy. When evaluating buying strategies, management should conduct a thorough review of the business with discussions in the following five areas. These discussions can be conducted in-house between energy and financial management leadership or in partnership with a potential electricity supplier.

1. Understand the effects of energy policy on the business. As the largest energy consumers, industrial businesses may be particularly sensitive to changes in electricity industry regulations, with concerns amplified if multiple facilities exist in different regulatory districts. Regulations are subject to continual change; their impact on the business is twofold. First, the anticipation of new regulations can produce spikes and dips in the wholesale electricity market. Second, regulatory changes may force change in how industrials procure electricity. The governance of rate changes, methods of applying service charges, contract structures, and other issues can work their way deep into the business and the bottom line.

A cost-control procurement strategy must take into account the current and pending state and federal regulatory landscape. The flexibility of a custom buying strategy can position an industrial business to adequately prepare and respond to policy changes. Considerations for discussion include:

- Do we have a firm grasp on policies that currently affect our procurement options and budget? Are we making the most of the opportunities within this regulatory climate?

- Do we have a clear picture of pending legislation?

- Does our procurement strategy allow sufficient flexibility to respond to policy change?

2. Assess the reliability of sources for information about market dynamics. Understanding the nuances of market dynamics requires constant monitoring and deep knowledge of market behaviors. The market moves quickly. If the delivery of vital market information and recommendations to key personnel lags, you may miss cost-control opportunities. The more direct the connection between your information source and the wholesale market, the better equipped you will be to make opportunistic buying decisions. Considerations for discussion include:

- Do we have the organizational capacity to constantly gather and analyze market information?

- If we obtain market information from external sources, do we understand their methods for obtaining and interpreting the data? Are they knowledgeable and objective?

- Do they provide information in a timely manner, enabling proactive decisions? Can they also execute?

- Are communication channels effective, or is there a drag that results in missed opportunities?

- Do they represent other businesses on the market? Where are we in the information-delivery queue?

3. Commit to a buying strategy based on business objectives. Electricity procurement can bring the greatest value when it permits flexibility that supports production cycles and profitability goals. Procurement is then no longer a strictly prescribed formula that applies to the entire contract term. A value-added procurement strategy blends fixed-price buys, which seizes opportunities while respecting business constraints. Devising such a plan requires an understanding of the interplay between business objectives, usage profile, load requirement, and market conditions.

The industrial business is a dynamic operation that experiences natural variances throughout the year. When the electricity-procurement plan is also dynamic, the business is better positioned to make operations adjustments and gain cost control.

Successful cost control also requires consensus and an agreement that the ultimate objective is predictable, long-term profitability. Management personnel should clearly understand their responsibilities in executing the procurement strategy so that, when opportunities to lock in advantageous pricing arise, the company is positioned to respond quickly. Considerations for discussion:

- What philosophy drives our budgeting practice? Is our sole purpose to meet budget, or do we allow for variances viewed within long-term objectives?

- Who is ultimately responsible for planning and executing our procurement strategy? Are all parties in agreement on business objectives?

- How does electricity factor into our cost of goods sold?

- Do we have control over consumption patterns in association with a demand-response event?

4. Review data that reveals opportunities for improving performance. If the right data is available and applied across the enterprise, you will be better equipped to successfully forecast budgets, plan production cycles for optimal profitability, and manage credit and cash flow. Industrials that proactively adopt an informed planning approach manage the interplay between load requirements and pricing, and can gain greater cost control over the short and long term.

When the electricity-buying strategy is aligned with business objectives, cost-control opportunities are no longer isolated to the energy line item. A frequent review of reports available from the energy supplier can support benchmarking and continuous improvement initiatives throughout the enterprise. Considerations for discussion:

- Does this procurement approach include reports that we can apply to our continuous improvement efforts?

- How does estimated spend compare with actual? Can we explain variances? Is reporting delivered in time to make mid-month adjustments? Is our business agile enough to make monthly adjustments?

- Do we receive clear information on daily wholesale market pricing?

- Can we monitor our forward purchasing for long-term position?

- Are we receiving reports that support prudent cash-flow management?

- Can we compare and evaluate the performance of different facilities?

- Can we easily determine our supplier's performance?

5. Calculate true costs. The true costs of electricity procurement include the overhead of contract-management activities in addition to the electricity spend. When evaluating any buying strategy - be it a traditional retail, fixed price, or custom portfolio - consider the costs required to execute procurement responsibilities. Considerations for discussion include:

- What internal/external resources are required to issue RFPs, review bids, and execute contracts? How do these responsibilities affect productivity?

- Does the implementation of the proposed strategy require new technology, equipment, or training?

- Will this strategy require hands-on personnel time?

- Do reports from the service provider enable agile decision-making or must we invest additional time to extrapolate and analyze?

Even amidst the daunting conditions of a volatile energy market, industrial enterprises can develop an electricity procurement strategy that operates in full support of enterprise-wide cost-control efforts: To do so requires an understanding of direct wholesale market buying opportunities and a new method for evaluating procurement contracts.

Cost-control opportunities emerge from a more profound understanding of usage, risk tolerance, and a custom portfolio of procurement strategies that can support business objectives with opportunistic, value-added buys.

This information was provided by Pittsburgh-based Strategic Energy, one of the largest competitive retail energy providers in the United States, with extensive, hands-on experience in helping industrial enterprises in deregulated markets implement custom energy-purchasing strategies. To learn more, visit (www.strategicenergy.com) or call (800) 830-5923.