How Tax Incentives Make Energy-Efficient Reroofing a Smart Investment

Key Highlights

- Energy costs for electricity and natural gas are rising sharply, increasing operational expenses for commercial buildings.

- Many existing roofs are under-insulated, leading to higher energy consumption and reduced thermal efficiency.

- Replacing roofs with code-compliant insulation can save up to 11% annually in energy costs, depending on location and building type.

- Recent tax law changes, including expanded Section 179 deductions, make roof upgrades more financially accessible and attractive for business owners.

Energy costs are on the rise. Federal data from August 2025 shows electricity prices are 5.5% higher and natural gas is up by 13.8% compared with last year. These increases are far from slowing down. The Center for American Progress notes that nearly 60 utility companies are expected to raise rates this year by more than $38 billion.

For commercial building owners and facility managers, the challenge is compounded by an aging building stock. Most commercial buildings were constructed before modern energy codes were widely adopted. This means they often lack energy-efficient features common in new buildings such as proper building envelope insulation and air sealing. The lack of an adequate thermal envelope can force HVAC systems to work harder to maintain stable indoor temperatures, increasing energy use and driving up utility bills. Over time, this performance gap will only widen if left unaddressed, making buildings less efficient and more costly to operate.

Amid rising costs and aging structures, one of the most cost-effective ways to cut energy use is to replace aging building components as and when they reach the end of their service life. On a typical commercial building, an energy-efficiency roof replacement offers one of the biggest opportunities for reducing energy consumption and easing the financial strain on building operations.

The Roof’s Role in Energy Costs

In commercial buildings, a roof is often the largest single surface in direct contact with the external environment, making it a crucial factor in overall energy performance. Yet, the U.S. Energy Information Administration’s Commercial Building Energy Consumption Survey (CBECS) finds that many existing low-slope commercial roofs are often under-insulated, often by 50% or more, compared with current code requirements.

Roof replacements are the most common building envelope alteration and, because of their scale and exposure, the most impactful envelope-specific measure for upgrading a building’s energy efficiency performance. A new roof with code-compliant levels of insulation, at minimum, can directly improve a building’s thermal performance, enhance occupant comfort, and lower energy costs.

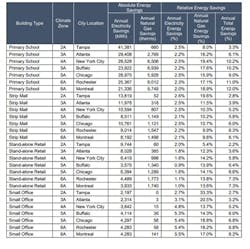

To quantify the benefits, the Polyisocyanurate Insulation Manufacturers Association (PIMA) commissioned a third-party study evaluating code-compliant roof replacements across different climate zones and building types. Results (at right) showed that reroofing a building with code-compliant levels of insulation, at minimum, can generate whole-building energy savings of up to 11% annually, depending on location and building type. For commercial building owners, that means reduced operating costs, improved occupant comfort and greater resilience against fluctuating energy costs.

Polyiso Roof Insulation Can Help Maximize Roof Performance

Insulation is a critical factor in roof system energy performance. With one of the highest R-values per inch among insulation options, polyisocyanurate (polyiso) insulation packs industry-leading thermal performance into rigid foam boards that enhance the durability and energy-savings performance of roof systems. As such, polyiso is the key component in a roof system’s ability to reduce heating and cooling demands, lower overall energy consumption, and maintain consistent and comfortable indoor conditions.

In many retrofit applications, rooftop constraints such as door thresholds, parapets, or mechanical equipment limit the available space for additional insulation. The thinner profile of polyiso enables higher R-values within these constraints, allowing reroofing projects to support greater building efficiency and deliver long-term operating savings.

Congress Delivers Enhanced Tax Benefits for Building Retrofits

Financial incentives further strengthen the case for roof upgrades, often helping to offset the costs of improvements like increased roof insulation levels. The new H.R. 1 (commonly referred to as the One Big Beautiful Bill Act) delivered numerous tax benefits to businesses, including a doubling of the allowable deduction under Section 179 of the tax code, making roof replacements a more affordable and strategic investment for qualifying commercial building owners.

Typically, businesses are required to recover the costs of capital improvements, such as reroofing, over the useful life of the improvement. For nonresidential real property, the costs of improvements are often depreciated over a 39-year period unless the property or improvement meets specific rules for bonus depreciation. This means the financial and tax-savings benefits of the investment are stretched far into the future.

The increased dollar limit thresholds in the updated Section 179 expensing change this dynamic for qualifying businesses. In certain scenarios, business owners can deduct the full cost of qualifying property in the same year the property is placed in service. In most cases, the business must both own the property and use it for business or income-producing purposes.

Under H.R. 1, the maximum allowable deduction under Section 179 is now $2.5 million (more than double the previous limit) for qualifying property placed in service after Dec. 31, 2024. This benefit begins to phase out for businesses with total annual qualifying expenses that exceed the $4 million limit. The deduction is reduced dollar-for-dollar by the amount over this threshold. As a result, the benefit completely phases out for businesses with more than $6.5 million in total annual qualifying expenses. Importantly, these dollar limits are indexed for inflation beginning in 2026.

Section 179 Expense in Action

For example, say a business invests $3.9 million in qualifying improvements in early 2025, including a $600,000 roof replacement. Because total investments remain below the $4 million phase-out threshold, the owner can claim the full $2.5 million Section 179 deduction. The roof replacement cost is included in the immediate deduction, providing a clear cash flow benefit.

To illustrate a partial phase-out of the benefit, say a business invests $5.2 million in qualifying property, including a $600,000 roof replacement. Here the total investments exceed the $4 million cap by $1.2 million. Consequently, the maximum $2.5 million deduction is reduced by $1.2 million, leaving a Section 179 deduction of $1.3 million. In this case, applying Section 179 to the $600,000 roof replacement is particularly valuable because reroofing projects do not ordinarily qualify for bonus depreciation. The remaining property would follow bonus depreciation or standard cost recovery rules as applicable.

On the other hand, if a business invests $6.7 million in qualifying property, it exceeds the cap by $2.7 million—greater than the maximum deduction of $2.5 million. As a result, the Section 179 deduction is fully phased out. In this case, any roof replacement and all other investments would be subject to bonus depreciation or the traditional cost recovery schedules.

Accelerated cost recovery improves cash flow by reducing taxable income in the same year the investment is made. Immediate expensing is more valuable than spreading deductions over decades because of the time value of money. After all, the value of cash retained today may be worth more than deductions realized years in the future.

Business owners should consult their tax professionals to determine how the enhanced Section 179 rules, along with bonus depreciation provisions, apply to their specific circumstances. Additionally, the Internal Revenue Service (IRS) maintains Publication 946, How to Depreciate Property, that explains how businesses can recover the costs of certain investments. It should be noted that the IRS is in process of updating existing publications to reflect the impacts of H.R. 1.

Thermal Efficiency and Financial Strategy Aligned

With rising utility costs, aging infrastructure, and favorable tax policy, the business case for reroofing with high-performance insulation has never been stronger. Roof replacements now offer a dual advantage: long-term energy savings and short-term financial relief. Forward-looking building owners who prioritize these upgrades will position their properties for greater resilience, efficiency, and profitability in the years ahead.

About the Author

Justin Koscher

Justin Koscher is the president of the Polyisocyanurate Insulation Manufacturers Association (PIMA). To learn more about the study on the life-cycle benefits of energy code-compliant roof replacement, visit https://www.polyiso.org/page/EnergyCarbonSavingsAnalysis.