Transform Facility Management into a Business Unit

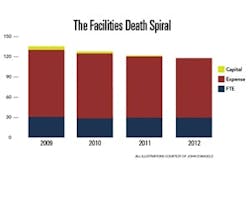

Many healthcare organizations are trapped in a facilities death spiral. Increasing operating costs and decreasing revenues create a severe underinvestment in facilities recapitalization. The underinvestment then causes an increase in operating costs through emergency repairs and a decrease in revenue due to poor patient experiences.

Facility managers can help break this cycle by transforming the FM department from a cost center into a business unit.

Requirements and Risk

Healthcare infrastructure is generally underfunded compared to other institutional facilities. It is not uncommon to find roofs, generators, and air handling units in place beyond their service life even after they develop a costly maintenance history. The common refrain from facility managers is that they request capital every year but can never get their projects funded due to competition with clinical equipment.

In most hospitals, FM is considered a cost center or a no-value-added function that needs scrutiny. With economic pressure from the recession and increased fear from healthcare reform, there is a special opportunity to transform FM into a business unit charged with the efficient management of its program.

Two hundred years ago, the physician could carry all of the tools of his trade in his medical bag – meaning that his practice did not have requirements for specialized infrastructure. Two hundred years from now, what was old may be new again with telemedicine, cloud computing and portable imaging. But today diagnostics and intervention require very specific power, ventilation, and other infrastructure support to achieve good outcomes.

The key word is “requirement.” Many FM budgets are not based on requirements but on what was spent last year. Without an understanding of the former, neither Finance nor FM knows if the amount of money provided is sufficient or how to mitigate risk if it is not. More importantly, without a thorough understanding of requirements, FM will forever remain a cost center instead of evolving into a business unit.

Focus on Performance Parameters

Requirements are not financial – they are performance parameters. Your operating room requires 68 degrees F., 35% humidity, and 25 air changes per hour to meet standards. Your facility needs 60 megawatts of emergency power, a watertight envelope, and positive pressure for room G-111. These requirements are tied back to your hospital’s mission, and your charge as a business unit is to meet it in the most efficient manner. Although most organizations understand their requirements from a code perspective, they struggle to find the right language to translate requirements into resources.

Requirements can often be fulfilled with different combinations of resources. Corporations break up resources into categories to help them meet regulations or benchmark performance, but these categories are artificial. Resources are resources.

To illustrate, think of a fleet car that requires an oil change every 3,000 miles in order to maintain the warranty. The risk of failing to meet the requirement is loss of the warranty and premature engine failure. Assuming that the risk is undesirable, the owner must determine the best way to change the oil every 3,000 miles. In this example, the owner can change it himself or outsource the oil changes. Which is more efficient?

For this example, the insource method takes a $17-per-hour employee one hour and $10 in oil and filter expense ($17 + $10 = $27). The outsource method takes 15 minutes of an $8-per-hour employee to drive the car to the oil change place and back where the “all in” cost of the change is $25 ($8/4 + $25 = $27). Both methods have the same cost.

Now assume that the owner does not want to risk the warranty coverage but he also does not want to provide the resources for the full requirement due to budget cuts. In this case the size of the requirement is significantly bigger than the resources dedicated to achieving it – in other words, the budget cuts were independent of the cost of the requirement. Consequently, the requirement is not fulfilled and the unwanted risk is incurred.

If only 25% of the resources are provided, then the owner can change the oil only every 12,000 miles, invalidating the warranty. Worse yet, requirements are performance parameters and not financial indicators. As such, they have a tendency to become self-fulfilling. Reducing oil changes will eventually cause the engine to seize. The “savings” achieved by not fully resourcing the requirement is significantly smaller than the emergency capital cost for an engine replacement.

A performance-based requirement is independent of the resources provided. Starting from the requirements allows FMs to understand risk better and manage resources efficiently. More importantly, it provides a common language and understanding for decision makers outside of the FM organization.

This is not a magic cure that gets FM all the resources it needs – it simply allows the FM requirements to compete at the same level of understanding that senior leaders have for other programs. In other words, it allows FMs to function as a business unit with predictable outputs for given resource inputs instead of the bottomless pit that no amount of resources can fill.

These five steps will help you to transform FM into a business unit.

1. Understand the missionof each hospital area.

Talk to your clinical and support staff. Often they have ideas to improve patient outcomes and safety on their floors, but they don’t know where to take them. Find out what functions are currently performed and any plans for expansion or change that you may not be aware of. Since requirements are cumulative, missing someone’s needs will impede overall patient care.

2. Quantify and qualify each requirement.

Identify not only how much power is needed for normal, critical, life safety, and emergency uses but also where the power should be located. Determine total cubic feet per minute of supply and exhaust and size your systems accordingly. Determine volume and head of domestic water, footcandles of lighting, and locations and volumes of process air.

Although your hospital met its initial requirements, since then requirements have changed dramatically. You may be maintaining stuff that you don’t need and need stuff that you don’t have. Another name for this step is retro-commissioning, but be wary of the tendency to focus on maximizing the efficiency of existing systems instead of understanding requirements and letting them drive the systems.

3. Identify the best way to meet each requirement.

There are wrong ways to meet requirements, but there are no definitively right ways. A way that wastes resources is wrong. A way that meets your requirements and manages your risk may be right.

Don’t focus prematurely on your equipment inventory – doing so may lock you into an inefficient solution. If you need 500 tons of peak cooling and you have a 700-ton chiller installed, you may be tempted to check that requirement off without looking at better ways to meet it, such as recapitalizing and downsizing through an energy performance service contract.

4. Identify the resource foreach requirement.

This step develops your business plan for the year and produces your FM budget. It is very important to go through the process and logically translate requirements into resource needs. The key to this step is not to focus on the financials but on the requirement.

The oil change example that I used earlier represents an actual requirement for my organization. In this case, historical data showed that we average 12,000 miles per year. By talking to the staff, we determined the mileage for next year will be the same. We then determined that we have a mix of haul requirements and that these are best fulfilled by a light pickup truck. We had already calculated that it costs $27 per oil change whether we insource or outsource, so we budgeted $108 per year for the four oil changes required every 3,000 miles.

Instead of a number on a spreadsheet or buried deep within a larger number, this $108 now has meaning that is translatable across departments because each step from requirement through resourcing is logically linked. This allows the organization to compare requirements and fulfillment cost across the enterprise. It also allows the department to describe in detail the risk associated with resource cuts and allows departmental leaders the understanding of the underlying requirement.

5. Manage risk while looking for savings and investment opportunities.

Whereas most cost centers have some familiarity with the prior four steps, a business unit recognizes the value of the data that it has developed and uses it to ask questions that improve processes.

What is the risk of not supporting a staff requirement? Can we consolidate trips in order to reduce miles driven? Can we consolidate vehicles with another department in order to reduce inventory? Can we work with the manufacturer to maintain the warranty but push the filter cycle to 4,000 miles? Does an electric vehicle have an attractive payback based on reduced operations and maintenance costs?

If you do not answer each question, then you cannot answer the annual budget question: “What is the impact of a 10% cut to your program?” Failure to answer this question is the reason that most FM organizations end up with that cut every year. The common refrain of not having enough resources turns out to be not the fault of Finance, but of the FM department failing to function as a business unit. The process should sound like this:

“Four oil changes are required by our insurance carrier based on our average annual usage. A 10% cut to our vehicle maintenance line results in three oil changes per year. Neither our insurer nor the vehicle manufacturer is willing to let us increase the oil change interval. The risk can be mitigated by requiring Oncology and Orthopedics to consolidate their trips and schedule them twice weekly as well as requiring deliveries over 50 miles to use our negotiated delivery contract. Oncology reports no significant impacts with this strategy, but Orthopedics reports some risk, which can be mitigated by better inventory management. We evaluated a leased vehicle with maintenance included, but its payback is unattractive. We also evaluated an electric vehicle whose payback is greater than we would normally consider, but the marketing value, especially when combined with the 50-mile limit for self-deliveries, might be worthwhile.”

Most FM organizations already have the data necessary to accomplish the above. The difference is that a business unit doesn’t wait for the cut to come down from on high but is constantly challenging itself to find savings.

John D’Angelo is the Senior Director of Facilities at the Cleveland Clinic, where he has responsibility over a team of facility directors managing a portfolio of 204 buildings across North America. Prior to his appointment at the Clinic, he had 20 years of experience in the Civil Engineer Corps of the United States Navy.