2007 Annual Industry Forecast

Schools aren't offices and apartments aren't warehouses. Each of these types of real estate performs differently, but, as you'll note on the pages to come, many are being impacted by very similar economic conditions. The high cost of building materials, high energy costs, a housing market correction, the influx of Baby Boomers' children into communities and schools, job growth, and gross domestic product (GDP) are all factors that impact one or more of the real estate markets featured here.

With Chapter 1 of the Washington, D.C.-based Urban Land Institute and PricewaterhouseCoopers' 2007 Emerging Trends in Real Estate report titled "Nothing Lasts Forever," it goes without saying that the superior performance experienced by some markets has peaked. The pace of the ongoing economic recovery will slow, impacting construction activity and the investment outlook. To summarize many of these forecasts: If no unforeseen events rock the economy in 2007, look for stabilization and steady growth in the months to come.

OFFICE

National office absorption has been strong, and many cities have not been overbuilding. Third-quarter 2006 absorption reached a healthy 20.6 million square feet, with the suburbs responsible for three-quarters of that total. Construction completions of 7.34 million square feet show an environment of demand continuing to outpace new supply. With many projects in the planning stages and financing easy to arrange, all eyes are watching construction numbers closely, which are expected to continue and increase over current levels (but still be outpaced by absorption). Two notable exceptions are Washington, D.C., and Las Vegas.

The resulting decrease in available space, combined with sale prices well in excess of replacement costs, has added pressure for new construction, although the high costs of building materials and labor - combined with land costs driven higher by the housing expansion - have put a damper on office starts. As corporate profits and confidence continue to grow, however, we are expecting a continued expansion through 2007. The slowdown in housing construction will also create additional opportunities for selective office-space additions.

The national office-vacancy rate is currently just over 13 percent and has been steadily dropping. As demand continues to outpace supply, we expect it to drop further in 2007 and 2008. It may even show quarterly variations upward as it trends down.

Rents will continue to grow in the 5-percent average annual range nationally, with Austin, TX; New Jersey; Honolulu; Miami; San Francisco; Seattle; Minneapolis; and Houston expected to post higher rental growth than the national average. Sublet activity has been relatively tame; with continued strong demand and limited availability, there is little reason to expect any increase.

Overall, the office markets are in a healthy state of near equilibrium. Most U.S. markets are strong and none are showing the lack of available space that caused rent spikes in the late 1990s. Barring significant negative economic events, the next few years should be beneficial to both owners and investors.

Office Investment Outlook

Since 2003, the U.S. economy has evinced strong gross domestic product (GDP) growth. This surge began to translate into substantial job growth in the first quarter of 2005. Despite last year's increase, the economy has slowed in the second half of 2006, as evidenced by the monthly job-gain totals, which have averaged 120,000 jobs compared to 160,000 jobs in 2005. This decline is partially attributable to the fast-correcting housing market and cuts in production by domestic auto producers.

However, the foreign trade balance has turned from a drag into a small boost to actual growth. After a brief breather following the 2000 global economic boom, international trade is expanding at double-digit rates, with every region exporting at record levels. Supporting the U.S. trade balance is strong global growth along with the depreciated dollar, both of which should help offset the slowing effect of the cooling housing market on the U.S. economy.

The relative bargains associated with U.S. markets have translated into increased foreign investor interest. With cap rates at all-time lows, the pressure for rising rents and a forecast of benign Treasury rates bode well for investors looking to maintain the value of their investments with increasing operating income due to rising occupancy and rents. With the market experiencing higher transaction volumes in recent years, investors are increasingly looking outside central business districts to the suburbs for opportunities. As more jobs move to suburban locations, the viability of these properties improves despite higher vacancy rates. The IT and biotech industries have surfaced as growth sectors in markets like Boston; Washington, D.C.; and the Research Triangle Park in North Carolina. Both industries are more likely to take suburban campuses than downtown towers.

MULTI-FAMILY

The U.S. housing market has cooled markedly since peaking in 2005. Housing starts and home sales have declined by 20 to 30 percent in many areas, inventories of unsold homes are at multi-year highs, and price appreciation has slowed to single digits (and even turned negative in areas such as San Diego). Investors have left the market and shrinking housing affordability has reduced the pool of potential homebuyers.

The condo markets in previously "hot" areas like Florida, San Diego, and Las Vegas are especially vulnerable to oversupply and changing market conditions. A number of proposed condo projects will actually be built out as apartments because unit sales have fallen short of expectations. Condo conversions have slowed dramatically. Certain condos in desirable locations, such as transit developments in Hollywood, continue to sell briskly as higher monthly payments are favored over time on the freeway.

Meanwhile, the apartment market outlook continues to be robust. Rents are moving up as potential homebuyers are finding renting more attractive. Apartment rents jumped from 7 percent this past year to 10 percent in Boston, New York City, San Francisco, and Los Angeles, with further increases likely in 2007. Tight vacancies in these markets, many below 3 percent, are prompting new apartment development. For now, the apartment market has the brightest outlook in 2007.

As the housing correction moves further along, the housing market is likely to begin improving in 2007. As home sales stabilize to more normal levels of activity, buyers are likely to return to the market thanks to mortgage rates that are still among the lowest in 40 years. The speculative buyers of condos are gone, and an oversupply of units is keeping prices in check. In fact, many first-time buyers will have an attractive selection of condos to choose from if they decide to buy a home, build equity, and enjoy the tax savings of home ownership.

Multi-Family Investment Outlook

Investor demand for well-located apartments will continue well into this year. Pension funds want to buy apartment buildings just like they want to buy office buildings or industrial properties. They are moving into multi-family to diversify, and the high cost of housing assures low vacancy rates and an increasing revenue stream. On top of that, there is very little land left to build on in hot housing markets, coupled with an increasing wave of NIMBYism (not in my backyard) against higher-density development.

As long as the economy remains healthy and avoids a serious slowdown, job growth should remain healthy, especially in the larger cities. The demand for well-located apartments should remain robust as the children and grandchildren of the Baby Boomers are starting families later and prefer living in downtown areas near their jobs - one key reason why institutional investors are more attracted to urban infill developments. As more cities like Los Angeles move to shore up their public-transportation systems, developers are also attracted to neighborhoods located along future mass-transit lines. Cities are eager to give approval for developments in former industrial areas, whether it's for new construction or the redevelopment of obsolete office properties. For example, Archstone Boston Commons recently opened as the first high-rise apartment community building in downtown Boston in 20 years. Buyers will continue to be lured by the central locations, the proximity to commuter rail, and the character of these older buildings.

RETAIL

The U.S. Commerce's construction put-in-place valuation data hints at surging construction costs and tells of booming nominal growth in shopping-center construction spending (see chart). Shopping-center construction spending (new and alterations) grew at a year-over-year pace that was greater than 50 percent in every month of available data for 2006. Indeed, in October 2006 (the last full month before press time), construction soared nearly 62-percent above its October 2005 spending. This is partly a function of the high costs of construction, but also reflects a lot of the projects started in prior years finally coming to completion.

Looking to 2007, there is clearly a relationship between the retail real estate sector and residential construction activity. Wherever the commercial sector (retail in particular) is heading, the residential sector will get there first. Watch the residential sector as a leading indicator of retail real estate construction development with a 1- to 1.5-year lead time. Additionally, watch the Washington, D.C.-based American Institute of Architects' Architecture Billings Index, another leading indicator of commercial construction.

Judging from these leading indicators, a slowdown in retail real estate construction seems likely, but a moderate one is expected for 2007. However, retail real estate performance is dependent on more than just the construction fundamentals; it is also dependent on consumer fundamentals that fuel ongoing business and rent. Although consumer spending has slowed in 2006, the pace of consumer spending is likely to stabilize in 2007. Both total consumer spending and shopping-center-inclined sales are likely to grow at a more trend-like pace in 2007. To summarize, retail real estate is expected to perform well in 2007, but largely based on an economy that is expected to see more stabilized or long-term trend growth.

Retail History

Through the first 10 months of 2006, new construction (new starts and additions) of U.S. retail space slowed by 6 percent compared with the same period of the prior year, according to McGraw-Hill Construction. The 2006 slowdown followed solid expansion in the previous few years. After an 18-percent surge in the starts of new retail space in 2003, the pace moderated by half to a still-strong 9.2-percent gain in 2004. By 2005, the pace of retail construction starts increased by a third - up 3.1 percent. During the same period of 2006, retail alterations were off 11 percent from the comparable period in 2005. Clearly, the 2006 weakness in retail construction start activity (a leading indicator of retail real estate construction spending) points to modest overall retail real estate construction spending for 2007.

Construction starts can be lumpy in different retail segments, and this was certainly true for 2006. Big-box retail space, which accounts for more than a third of the new retail space built and is the largest segment that McGraw-Hill Construction tracks - was running nearly 17-percent below its planned expansion for the comparable January through October period of the previous year. In 2005, big-box retail space grew by 7 percent; the 2006 pullback reflects the "lumpiness" that is characteristic of large-scale projects.

Community shopping-center development, which accounted for almost 9 percent of the 2006 retail space expansion during the first 10 months of the year, is still an engine of growth, with a hefty 32-percent increase on a 2006 year-to-date basis. Neighborhood shopping centers, which accounted for just over 8 percent of new retail space in 2006, grew a modest 0.2 percent, but followed gains of 11.2 percent in 2004 and 12 percent in 2005.

Retail space as part of a mixed-use development has been a success story for a number of years, including 2006. By square footage, retail construction starts associated with mixed-use projects surged by 52 percent in 2003, followed by a 38-percent increase in 2004. By 2005, that segment continued to grow with a 6.4-percent gain. From January through October of 2006, it was up nearly 20 percent. More generally, mixed-use is a "rising star" for future real estate development, and retail is often a crucial component in these projects. In 2002, retail mixed-use represented 4.9 percent of all retail space expansion; by 2006, the share of mixed-use retail expansion had doubled.

Restaurant and entertainment construction and department store conversions are two other areas of healthy retail construction start growth in 2006, which should have a lingering and positive impact on 2007 retail industry construction spending. While these commercial starts may have a long lead time until completion of the retail projects, they do provide an understanding of where the hot and not-so-hot areas of retail growth are, and what will be coming in 2007 and beyond.

INSTITUTIONAL (EDUCATION)

What's the biggest driver of education-sector opportunities for design and construction firms? In a word: students. Population growth is a main factor in new construction and additions in the education sector, making it one of the largest and brightest heading into 2007. According to the U.S. Census Bureau, enrollment in K-12 schools, which increased sharply through the 1990s, is expected to remain high through 2014. The South and West are expecting the sharpest increases (at 3.2 percent and 7.5 percent, respectively) between 2008 and 2014. That same bubble of students now putting pressure on middle and high school capacities in some areas of the country will also influence higher-education construction trends in a few years.

Additionally, increased tax revenues - the result of a booming residential real estate market over the past several years - has contributed to the upward trend in K-12 construction. While the recent downturn in the housing market could signal potential trouble, a number of bond measures passed in November 2006 may counteract that slide in some parts of the country (particularly California, Oregon, New Mexico, and North Carolina). Similarly, if material costs dip, which is a possibility in light of falling oil prices at the end of 2006, opportunities in the K-12 sector may increase as funding-starved projects regain momentum.

American School & University magazine's annual education construction report finds that higher-education institutions are expected to complete more than $44 billion in projects between 2006 and 2008, which accounts for about 46 percent of the projected total $125 billion in anticipated projects in all areas of education construction.

According to a survey of firm leaders conducted by Natick, MA-based ZweigWhite for its annual AEC Industry Outlook report, the higher-education market climbed two places from the previous year to rank as the projected second-hottest sector in the industry heading into 2007. K-12 schools rounded out the top 10 hottest sectors, down one place from No. 9 on last year's survey.

In addition to new construction projects to serve the demands of increasing enrollment at all levels, the need for upgrades and modernizations to existing facilities continues to increase, so the education sector is expected to remain a large and important market for 2007 and beyond.

Education Trends

Reports of total education construction from the U.S. Census Bureau indicate that both K-12 and higher education grew 6.5 percent in 2005. At press time, 2006 was on track to be a growth year, too, as evidenced by a 4.5-percent increase in the seasonally adjusted annual rate of construction put in place in the first three quarters of 2006. Reed Construction Data and McGraw-Hill Construction both project double-digit growth for 2006, reporting an increase of 12.1 percent and 10 percent, respectively.

American School & University magazine reports that K-12 school districts put in place $22.9 billion worth of construction in 2005, which breaks down as $12.2 billion in new construction, $6.2 billion in additions, and $4.5 billion in modernizations. While still a strong market, the K-12 sector has flattened since 2004, primarily due to the postponement of modernizations because of rapidly rising material costs. Although the overall K-12 market has stalled in 2006, additions and new construction rates were actually higher than the previous year.

While the K-12 market has leveled off somewhat, the higher-education market is growing. Increased college attendance is placing a strain on campus infrastructure; enrollment is expected to climb through 2014 to nearly 20 million students. Competition for the best students is also increasing, and state-of-the-art housing, classrooms, and campus amenities are important tools for wooing students, further fueling a surge in construction. College Planning & Management magazine reports that colleges expect to complete nearly $14.4 billion in construction in 2006, with more than $10 billion of that going to new construction projects.

HOSPITALITY

Consistent with PricewaterhouseCoopers' (PwC's) November 2005 and subsequent forecasts, the U.S. lodging industry continued to set new records with impressive gains in occupancy and room rates in early 2006. According to Hendersonville, TN-based Smith Travel Research (STR), U.S. revenue per available room (RevPAR) increased by 5.8 percent in the third quarter of 2006, primarily due to a 6.8-percent increase in average daily rate (ADR) with the average occupancy reaching 68.5 percent.

At press time, PwC's forecast predicted slower growth of room demand for year-end 2006 at 1.9 percent, down from 3.1 percent in 2005. U.S. lodging supply growth through year-to-date September 2006 was restrained at 0.4 percent and is forecasted to end the year at 0.7 percent. Therefore, the occupancy is expected to reach 63.8 percent in 2006, the highest since 1997.

Room rate growth in 2006 is expected to accelerate at 6.8 percent, while RevPAR is forecasted to increase by 8 percent in 2006 to $61.94. Inflation-adjusted RevPAR is forecasted to reach $59.90, the highest since 2000. RevPAR growth is forecasted to slow to 5.2 percent and 5.1 percent in 2007 and 2008, respectively.

RevPAR growth will continue to be achieved more from ADR gains through 2007, thereby contributing to increased industrial profits, which are forecasted to grow by 11.6 percent in 2006 to $25.3 billion and by 8.5 percent in 2007 to $27.4 billion.

Economic Factors Impacting Lodging

Trends in the U.S. economy are important to the lodging industry because the elasticity of lodging demand to gross domestic product (GDP) is approximately 0.7 (i.e. if the economy grows by 1 percent, lodging demand increases by 0.7 percent). The effect of changes in GDP continues for four calendar quarters.

The U.S. economy slowed significantly during the second quarter of 2006, with real GDP growth of 2.9 percent, following an unsustainably strong growth of 5.6 percent during the first quarter. A combination of factors contributed to the slowdown, including:

- Higher energy prices.

- Increasing interest rates.

- Weakening housing markets.

- Stock market volatility.

The trend of slower economic growth is forecasted to continue through 2007. According to Macroeconomic Advisors LLC's Aug. 22, 2006, Economic Outlook, the following describes the key assumptions behind the current macroeconomic outlook through 2007:

- Oil prices, after averaging over $70 per barrel in the second quarter of 2006, are expected to peak at about $79 per barrel by the summer of 2007 and move slightly lower by the end of 2008.

- Equity markets are expected to remain moderately strong, with the equity valuations anticipated to be close to the lower end of the fair-value range.

- Interest rates expected to remain at the current level in the near-term future.

- Existing home prices are expected to decelerate and rise by a cumulative of 4.3 percent through the end of 2008.

- Global economic growth is expected to remain strong with the trade-weighted foreign GDP in 36 countries forecast to grow by 3.8 percent in 2006, 3.4 percent in 2007, and 3.6 percent in 2008.

INDUSTRIAL

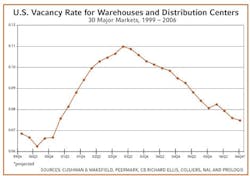

The nation's current real estate recovery is now nearly 4 years old (and counting). The overall vacancy rate for the nation's top 30 distribution property markets declined to about 7.5 percent at year-end 2006 from 8.1 percent a year ago. Leasing market conditions nationwide have tightened to the point where property owners are now in the driver's seat, with enough leverage to push rents higher.

Looking ahead, it's anticipated that market conditions during the coming year will largely be a repeat of what they were in 2006. At this mature stage of the real estate cycle, with the pace of new construction having picked up and converging toward the growth in demand, the national vacancy rate should decline further during 2007, but its rate of descent will surely not be as steep as it has been during the past 4 years. New construction has remained well disciplined throughout the current cyclical upturn, and no let-up is predicted.

In short, next year should be another good year for property owners. Asking rents for distribution space are on the rise. They increased about 8 percent during the four quarters of 2006, after having risen 5 percent during the previous four quarters. In contrast, "core" inflation in the United States (i.e. excluding food and energy prices) amounted to 2.25 percent during the same year-long period. As of year-end 2006, rents had succeeded in finally surpassing their previous cyclical peak, reached in early 2001. In 2007, leasing-market conditions should remain tight and maintain the stiff upward pressure on rents.

The main risk to the outlook would be an interruption in the U.S. economic expansion, triggering a cyclical downturn in the U.S. distribution property market. In that case, the supply of newly built space - as disciplined as it has been - would overwhelm net absorption (demand).

Industrial New Construction Outlook

One of the distinguishing features of the current upswing of the U.S. distribution property markets is the remarkable restraint displayed by developers. Invariably, in the past, they have tended to be overly exuberant during cyclical upturns, leading to overbuilding and then to market corrections.

Developers have been decidedly more cautious this time around. During 2006, new starts of distribution facilities totaled about 135 million square feet in the top 30 markets, a modest 2.6-percent increase in the inventory in place. This discipline is all the more remarkable considering the strong incentives encouraging developers to act boldly: improving leasing market fundamentals, falling cap rates, and heavy inflows of institutional money.

Despite these large inflows of institutional capital and the willingness of those investors to assume the lease-up risk inherent in new projects, industrial development today is less prone to overbuilding than it used to be.

- Commercial property leasing markets are much more transparent today, thanks to the growing importance of the REIT and Commercial Mortgage-Backed Securities (CMBS) markets, and the SEC's stringent disclosure rules. As a result, investors, developers, and lenders are able today to track supply and demand trends more accurately, leading to better-informed, more-efficient decisions about new construction projects.

- The regulatory rules governing commercial construction lending are much more stringent today, and also more rigorously enforced.

- There are fewer lenders today, and those that do exist are also bigger, owing to long-standing commercial bank consolidation and to the dearth of non-bank lenders, such as S&Ls.

- Bigger banks prefer to do business with the industry leaders. Among the pool of aspiring developers, it's the "little guys" who are getting squeezed out.

- Distribution facilities tend to be much larger today than they used to be, requiring larger land positions and larger finance requirements.

At the first sign of overbuilding, the institutions providing commercial-construction financing would recognize the problem and react quickly to limit their exposure. No one wants to be stuck with vacant properties entailing substantial write-downs.