Mid-Year Forecast: Commercial Real Estate Will Perform Favorably

Commercial real estate should fare well in the second half of 2006 as measured by demand from both tenants and investors. Conditions will be similar to the first half as the nation’s economy continues to expand, but there will be some mid-course adjustments necessary for tenants, landlords, buyers, and sellers.

Office Market

The U.S. office market vacancy rate declined for an eighth consecutive quarter, ending the first quarter at 14.3 percent. However, vacancy remains above the generally accepted equilibrium rate of 10 to 12 percent, a sign that tenants continue to call the shots in quite a few markets. The Inland Empire area (Riverside, San Bernardino, and Ontario) of Southern California posted the lowest vacancy rate among major U.S. markets at just 7 percent, followed by New York City (Midtown, Midtown South, and Downtown combined) and Orange County, CA. Dallas-Ft. Worth and Detroit posted the highest major-market vacancy rates at just above 20 percent. Downtown Dallas has a chronically high vacancy rate, while developers are quick to break ground in the suburbs; Detroit is home to the restructuring domestic automobile industry.

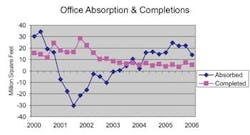

Demand continued to outrun new supply by a wide margin in the first quarter, as it has for the past eight quarters. Space under construction crept up only slightly and remains well below recent levels of absorption, suggesting that markets will continue to tighten as the year progresses - particularly since high construction/labor costs and rising interest rates make it tough for developers to introduce new product. Washington, D.C. and its Virginia and Maryland suburbs accounted for 21 percent of the total in the construction pipeline at the end of the first quarter. Other markets with more than 3 million square feet under construction included New York City; Phoenix; Orange County, CA; and Atlanta.

Average asking rental rates continue to move higher, up by 7.2 percent and 3.6 percent for Class-A and Class-B space, respectively, over the past four quarters. Six markets posted double-digit gains in asking rental rates for Class-A space during this period, with five of them in California: San Francisco, San Mateo, Orange County, Oakland-East Bay, and San Diego, as well as Phoenix. Rental rates are most sluggish in the Midwest, including Milwaukee; St. Louis; Columbus, OH; Detroit; Cleveland; and Omaha, NE, as well as Fairfield County, CT.

The economy is expected to add 2 million to 2.5 million net new jobs in 2006, enough to push the office market deeper into the recovery cycle and further toward the expansion cycle. Expect leasing market conditions to shift gradually in favor of landlords over the next 12 to 18 months. Leasing and investor demand will be strongest in the major coastal markets over the next few years and weakest in the Midwest. In the Southwest and Southeast, job growth and leasing demand will be strong, but there are a few barriers to entry that could light a fire under rent growth.

Industrial Market

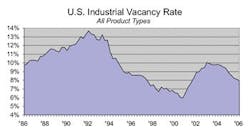

The industrial vacancy rate has fallen for eight consecutive quarters, but the rate of decline slowed to just 10 basis points in each of the past two quarters. Vacancy was 8 percent at the end of the first quarter of 2006, its lowest level since the third quarter of 2001. Eight markets recorded sub-5-percent vacancy rates, compared to six at the end of the fourth quarter. Los Angeles County, CA, once again recorded the nation’s lowest vacancy rate (at just 2 percent) thanks to torrid, port-related demand combined with limited land availability. Two nearby markets - the Inland Empire and Orange County - also made the list, followed closely by the three South Florida markets of Miami-Dade, Broward, and Palm Beach counties. Also on the list is Las Vegas, where land for industrial development has become an endangered species. At the other end of the spectrum, Raleigh-Durham, NC (a flex-heavy market still recovering from the technology bust several years ago), posted the nation’s highest vacancy rate at 18.4 percent.

After a rather sharp decline in the prior quarter, net absorption bounced back to 42.9 million square feet in the first quarter, enough to qualify as “strong demand.” Chicago and Northern/Central New Jersey absorbed 4.5 million and 4.2 million square feet of industrial space respectively in the first quarter, leading all other markets. Space under construction rose for a ninth consecutive quarter to 109.7 million square feet, a slim 10-percent below the all-time peak recorded in the fourth quarter of 2000. The Inland Empire led all markets in the construction ledger with 22.9 million square feet in the pipeline, far ahead of second-place Atlanta, with 13.6 million square feet under way.

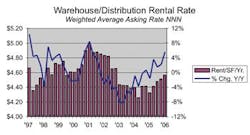

Rental rates are finally showing some life (to the delight of landlords and dismay of tenants). The average asking rental rate for warehouse/distribution space has bumped up 5.6 percent over the past year, ending the first quarter at $4.56 per square foot per year NNN (tripe-net lease). Even the hard-hit R&D/flex market saw a year-over-year gain of 4.5 percent, ending the first quarter at $9.53. Thirty-six of 48 markets posted year-over-year gains in warehouse/distribution rent. A number of markets have seen double-digit increases, including Long Island, NY; Miami; Oakland-East Bay, CA; Phoenix; and the Los Angeles region. Asking rental rates for warehouse/distribution space are still flat or declining slightly across parts of the Midwest and a few other scattered markets.

The extended slide in the vacancy rate has slowed considerably in the past two quarters, suggesting that the market is approaching its equilibrium vacancy rate, perhaps between 7.5 and 8 percent. A number of factors are in place to encourage even more construction: increasing rental rates, plenty of capital for development and investment, rising global trade, outsourcing of manufacturing activity, and ongoing streamlining of corporate supply chains. Even with high levels of construction, there are reasons to expect that rental rates will continue to rise at a slow-to-moderate pace in many markets: the lack of available land, competition for land with residential and other developers, difficult entitlement processes, removal of older product for redevelopment, and higher construction costs.

Retail Market

The emergence of mixed-use and lifestyle centers has had a huge impact on the retail market for both tenants and investors. These centers combine attractive retail tenants and dining options, and, in many cases, residential and office components. Investors are becoming more comfortable with mixed-use concepts. At the same time, they are exercising more caution toward traditional grocery-anchored centers, which are under pressure from Wal-Mart Supercenters and SuperTarget.

In the current market, restaurants are among the most active retailers, including such names as Baja Fresh, Chipotle Mexican Grill, and PF Chang’s. Brinker Intl. has divested some of its concepts and is focusing on core brands, including Chili’s, On the Border, Maggiano’s, and Macaroni Grill. Starbucks continues to expand rapidly. Other growing retailers include discount department stores, such as Wal-Mart, Target, and Kohl’s, as well as home-furnishings providers like Bed Bath & Beyond and Linens & Things. Movie theaters are expanding again, with mall owners viewing them as a way to build traffic.

Looking ahead, three general categories of retailers stand out for their growth potential: value-oriented/discount, upscale, and ethnically targeted stores. Value-oriented and discount retailers have a bright future. Companies like Wal-Mart, Target, Kohl’s, Tuesday Morning, and Ross and Marshall’s should continue to do well since consumers want quality without high prices. At the other extreme, upscale retailers will perform well since the nation’s wealthiest households have benefited from rising home prices, the improving stock market, and lower tax rates. And, lastly, retailers that target a specific ethnic group should do well.

There are reasons to think that consumer spending and retail leasing activity are poised for a fall (high gasoline prices, rising interest rates, a wobbly housing market, and burdensome levels of debt). But, don’t count consumers out yet. The economy is creating jobs at a moderate-to-healthy pace, and wages are rising after an extended dormant period. The housing market appears to be decelerating rather than crashing, while the Fed is nearing the end of its 2-year campaign to raise interest rates to a neutral level. Shopping-center construction is strong in fast-growing suburbs, on infill sites in mature trade areas, in downtowns where condo construction has been hot, and in ethnic neighborhoods where retailers want to unlock the growing sales potential. Rental rates for well-located, inline shop space in grocery-anchored centers rose by 6 percent in 2005, while sales prices for prime pad sites increased by 9 percent. Retail real estate should perform well over the next 12 months as the economy continues to expand, boosting rents and prices by 4 to 5 percent.

Investment

The commercial real estate investment market remained as hot as ever in the first quarter, even in the face of long-term interest rates that are finally beginning to rise. But, there are a few signs of stress that weren’t there a year ago. First-quarter commercial property sales with a minimum value of $5 million totaled $62.3 billion according to New York City-based Real Capital Analytics, down for the second consecutive quarter, but still 18-percent ahead of the year-ago quarter.

Of the four core property types, retail was the only type to post a year-over-year decline in transaction volume. This seems to reflect investor concern that elevated gasoline prices, rising interest rates, the downshifting housing market, and burdensome debt levels will take a toll on consumer spending and, eventually, tenant and owner-user demand for retail space. Retail property prices have risen the fastest in recent years, and the market appears to be cooling off to a more sustainable level.

On the other hand, industrial transaction volume soared to its strongest quarter ever, 55-percent ahead of the year-ago quarter. Industrial buildings are playing a lead role in the ongoing transformation of the global manufacturing and logistics industries, a process that could last for a decade or more.

Apartment properties will benefit from weaker home sales and higher interest rates, making them comparatively more affordable than home-ownership. First-quarter apartment transaction volume trumped the year-ago quarter by 30 percent. But, the slower housing market could deliver two unwelcome side effects for apartment sellers: Condo conversion activity is likely to downshift, removing an aggressive group of bidders from the competition for apartment properties; investors who purchased condo units in hot markets hoping to flip them may be forced to rent them instead, inflating the supply of rental units and short-circuiting rental rate increases.

Investor demand for office properties rose by 10 percent in the first quarter compared with the year-ago quarter. A broad, ongoing recovery in the office leasing market has supported low cap rates in the face of rising interest rates. In Midtown Manhattan, Southern Florida, Southern California, and a few other hot markets, investors seem willing to pay increasingly aggressive cap rates in the 5-percent range for trophy properties.

Insatiable demand in supply-constrained markets along both coasts is pushing capital into the interior of the country. Often, this takes the form of private investors, particularly 1031 exchange capital, looking for higher cap rates than are available in the hot markets. This flow of capital from the coasts to the interior of the country can also be viewed as a flow of capital from primary to secondary and tertiary markets. As the leasing market recovery becomes broader and deeper, many of these secondary and tertiary markets will see rental rates begin to rise, first for the best-located Class-A properties and then for a wider range of properties.

Expect property prices to remain broadly stable over the next few quarters. Rising rental rates will boost net operating income, at least partially offsetting the potential for higher capitalization rates as interest rates continue to rise. A spike in 10-year Treasuries could have a chilling effect on investor demand, particularly among leverage-dependent private investors.

Bob Bach is national director, market analysis, at Northbrook, IL-based Grubb & Ellis Co. (www.grubb-ellis.com). All graphs are courtesy of Grubb & Ellis Co.